Would you expect a RAC Approved Buysure dealer to sell a £9000 car with significant safety failings?

When Caroline bought a £9000 car from a RAC Approved Buysure dealer in 2014 she didn’t expect things to go wrong.

When Caroline bought a £9000 car from a RAC Approved Buysure dealer in 2014 she didn’t expect things to go wrong.

When they did, almost straight away, involving deficient tyres and brakes, she expected the dealer, the RAC or their 6 month warranty scheme to take care of her.

When none of them did, over time, she was understandably angry.

After joining us she asked us to check this scheme out and tell her story so women drivers like her might learn from her expensive experience.

We needed to be cautious here of course. Knowing that Citizens Advice receive more than 80,000 complaints a year about used cars and the RAC is a big business that trades on its reputation for trust, surely their scheme must be one of the best there is?

Maybe Caroline’s experience was a one off? But could there be flaws to the RAC Approved Buysure vehicle preparation standard where unscrupulous car dealers are concerned?

We decided to take on Caroline’s case and find out how the RAC goes about its Buysure approved used car dealer business.

We started by putting her lengthy story to the RAC for our own peace of mind, giving them time to look at this again and see what they could do for us.

Their brief reply (below & inaccurate about the finances and brakes) made their lack of customer concern clear and contained a sentence that worried us. Their Head of Media Relations told me that…

“…the Buysure scheme does not replace the buyer’s obligation to ensure the car is bought as advertised and they are satisfied about its condition at the time of sale.”

This, in a nutshell remains the essence of Caroline’s predicament. If an RAC Approved Buysure dealer doesn’t have to check that a car is sold as advertised and is satisfied with its condition at the time of sale, how does the RAC police the quality standards it promotes to motorists otherwise?

Put another way, perhaps motorists might be better off paying for a used car check to verify the financial and mechanical state of the car in question? And saving the equivalent of any warranty payment to go towards the cost of repairing any future failings themselves?

In Caroline’s case, she bought her dream £9000 car via the Auto Trader website because it was advertised by a RAC Approved Buysure dealer who confirmed the car had a MOT and had been serviced. On the strength of this she travelled 90 miles there and back to complete a big, important and complicated car transaction on her own (she’s a single Mum). This included Barclays car finance and the part exchange of her much loved 02 Mini before returning to collect her daughter from school. She clearly placed a lot of trust in this dealer and the RAC scheme.

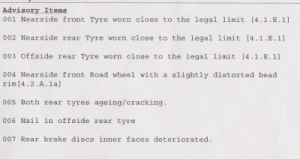

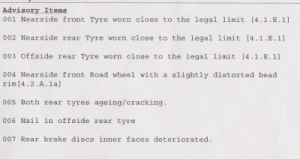

Very soon after she became concerned about the car’s handling and got the Buysure papers out. These included the car’s latest MOT (see below). She then read the service handbook to see the dealer had added the cheapest possible service, simply an oil and filter change. In fact the car hadn’t had a proper service during its life – a fact which the garage in question would have known when they bought this car, cheaply for sure.

So how could any RAC Approved Buysure garage have ticked the 82 point checklist without drawing Caroline’s attention to serious safety deficiencies?

Or better still, without addressing these and having the car re-MOT tested pre-sale?

If Caroline (or any other innocent motorist) had known the £9000 car had these failings and hadn’t been regularly serviced she (and any warranty company surely) would realise that expensive bills lurked around the corner. And go elsewhere.

The RAC Approved Buysure dealer website

The RAC website says

“The RAC Approved Dealer Network has been developed to give motorists confidence and peace of mind.”

“You can purchase your next car with confidence and peace of mind”

But nowhere does the RAC accept responsibility for approved car dealer failings? Which seems odd in an unregulated industry where the actions of a few bad dealers can affect the good reputation of the many?

We then looked at the Buysure Vehicle Preparation standard which seems to a non techie like me to be as thorough as one could be.

Other than the fact this it does not have to list any MOT advisories or that a car has been regularly serviced.

But anyone can write a car check list and badge it accordingly – surely the important thing is that it is policed in some way?

How does the RAC approve their Buysure Dealer network?

We wanted to know how the RAC vet and then police their RAC Approved Buysure dealers, especially the smaller ones. This is what they say.

‘We visit our Approved Dealers at least 6 times a year to check their vehicles are prepared to our standard’

This leaves a lot of room for leeway it seems to me. Some 350 days a year, which is worrying if you are an unscrupulous car dealer using the RAC Approved Buysure scheme as a sign of quality, to lure in unsuspecting motorists like Caroline?

We then looked at the vehicle preparation checklist and documentation. Maybe this was computerised so the RAC could look out for any comments/exceptions that might raise concern? No, these are handwritten forms and we doubt that the RAC sees all of them.

Perhaps it should put a simple system in place to identify exceptions?

Perhaps they should adopt a name and shame policy – or ask us to help here?

Presumably they monitor motorist feedback too? Strangely this didn’t happen re Caroline?

Caroline’s experience of the RAC Approved Buysure scheme

Here is Caroline’s story.

In April 2014 Caroline, a mum with two daughters and living in Norwich, found her dream Mini automatic convertible when car shopping at the Auto Trader website. The car was being sold by RAC Approved Dealer (no longer on their network), Whinbush Garage in Letchworth Garden City.

Caroline was happy because an RAC Approved Dealer was reputable and the car was part of the RAC BuySure scheme including a six month warranty, presumably based on the 82 point vehicle preparation checklist? She raised the car finance she needed from Barclays to complete the £9000 purchase price for her new and shiny silver Mini Convertible automatic.

The salesman had confirmed the car had a recent MOT and had been serviced by them so she felt sufficiently confident about things.

Just two weeks later she was unhappy about the Mini’s tyre grip in a local car park. At that stage she dug out the paperwork Whinbush had supplied. This contained the scanned MOT certificate stating sdvisories on it. All tyres were clearly in a poor condition and were close to the legal limit. One had a nail in it. (The BuySure Checklist said ‘normal wear’).

Just two weeks later she was unhappy about the Mini’s tyre grip in a local car park. At that stage she dug out the paperwork Whinbush had supplied. This contained the scanned MOT certificate stating sdvisories on it. All tyres were clearly in a poor condition and were close to the legal limit. One had a nail in it. (The BuySure Checklist said ‘normal wear’).

She then saw for the first time that Whinbush had indeed ‘serviced’ the car but this was the cheapest variety, namely an oil and filter change. Looking through the service handbook she saw the car had not had a full service at any stage of its history. Undoubtedly Whinbush knew this but failed to tell her.

Caroline got the car checked locally in Norwich to be told the tyres were no longer legal/safe. She bought a complete set of new like-for-like Pirelli runflats for £662. There was no longer any sign of the stated nail. Had the tyre been repaired?

The car was also ‘juddering’ and this was finally identified as the brakes yet Whinbush had ticked ‘Particular attention to the operation of clutch, transmission, steering, suspension and brakes including ABS’ on the Buysure checklist? This bill came to £190.36.

When asked about all this, Whinbush offered to replace the tyres at Caroline’s cost with a cheap Wanly brand she had never heard of. They dismissed the brakes invoice as wear and tear (as did the warranty company) but shouldn’t the RAC Buysure Scheme require safety items to be rectified and re-MOT’d pre sale?

All this time the car had been within a 6 month RAC Warranty, presumably secured because of the RAC certificate confirming the car had been prepared to the RAC 82-point approved preparation standard. We believe Caroline would have been within her reasonable rights to challenge the dealer within the Sale Of Goods Act if only to rectify the safety shortcomings and get a new MOT.

But she didn’t know of this, she was on her own and she trusted and expected the RAC to do the honourable thing by her.

To cut a long story short, Caroline involved as many parties as possible to help her get the car restored to the condition she expected it to be in, for the price she paid.

She wanted the RAC to inspect it, service it and pay for the tyres and brake repair.

The RAC accepted no responsibility despite their Buysure vehicle preparation scheme being a contributory factor here. They simply referred her to their Warranty scheme (operated by The Warranty Group) for the brakes claim knowing this would be dismissed due to their wear and tear terms.

Caroline was able to negotiate a goodwill gesture of £150 from Barclays which they deducted from Whinbush. She also received an ex gratia payment of £150 from a sympathetic lady at The Warranty Group who confirmed they were removing Whinbush from their warranty scheme.

Persevering with the RAC’s unsympathetic Head of Customer Care she was eventually offered a further £362 ‘in full and final settlement’ of any future claim against them. She would then have had the tyres paid for.

But she wanted the RAC to inspect and service her car instead, to give her the peace of mind she expected when she bought the car in the first place. They refused to do this, she felt a nuisance in her dealings with them and this matter is still unresolved.

The costs

Caroline has incurred costs of more than £10300 for the Mini that continues to let her down.

She received a total of £300 in compensation (from Barclays and The Warranty Group) but did not accept the £362 the RAC offered her because she still wants them to inspect and fully service her car instead.

These costs are

+ £9000 for a car that did not meet RAC BuySure vehicle preparation standards.

+ £662 for safety related new runflat tyres

+ £190 for safety-related brake repairs

+ a growing 50 hours of her (and our) time

Caroline has involved Citizens Advice, Trading Standards, the ASA, the Used Car Guy and finally FOXY Lady Drivers Club.

The RAC’s Buysure reply

“The RAC’s BuySure scheme aims to give buyers greater confidence in purchasing cars from RAC approved dealers as vehicles are prepared to the BuySure 82-point standard and come with at least three months’ RAC breakdown and RAC Warranty cover.

As the independent dealer Caroline bought her car from failed to meet its obligations under the BuySure scheme and then did not resolve her issues despite our requests, the RAC terminated its relationship.

However, it is important to understand that the BuySure scheme does not replace the buyer’s obligation to ensure the car is bought as advertised and they are satisfied about its condition at the time of sale.

The law in this kind of situation is clear that a buyer’s recourse is with the dealer who sold the car. Despite this the RAC made a £662 gesture of goodwill over and above its responsibilities to cover the cost of the new tyres. We are therefore very confident that we have done everything that could be reasonably expected of us to help Caroline.

As this still appears to have fallen short of her expectations the remaining options are to engage the government-backed Motor Codes organisation as an independent arbiter or to take action directly against the dealer. In the latter instance, the RAC would be happy to provide supportive evidence to help Caroline’s case.

The brake issue highlighted was declined as an RAC Warranty claim due to the fact it related to wear and tear of brake pads and discs, which are not covered under the terms of the product as they are classed as consumables. This was noticed six months after purchase meaning the wear and tear may have occurred in that time and not been evident to the dealer at the time of sale.

Simon Williams

Media Relations Manager

Our thoughts about the RAC Buysure scheme

1/ As things stand, even if the car is sold by a RAC Approved Buysure dealer, clearly the motorist is expected to check

+ the latest MOT for any serious/safety-related advisories

+ has a service history

If any used car doesn’t have a service history (and we’re talking about a £9000 car here remember) our advice is to WALK AWAY. It doesn’t matter how nice and shiny it is, it will let you down in time and any warranty company will claim a legitimate ‘wear and tear amendment.

The failing in this system is surely that a used car dealer who buys cars without service histories is able to sell them cheap without any innocent motorist realising what this means.

2/ I feel sorry for the many good RAC Approved Buysure dealers who use this marketing scheme in good faith.

If the RAC only audits Approved Dealers c6 times a year they are placing a tremendous trust on their fast growing network of used car dealers to do the right thing by their Buysure scheme during the remaining 350 days a year.

Presumably this is why Simon says ‘a buyer’s recourse is with the dealer who sold the car’ not the RAC?

This is a disappointing caveat emptor attitude for motorists to hear ie when things go wrong, you’re on your own.

In this case the dealer knew the car hadn’t been regularly serviced and failed to draw this to Caroline’s attention. She didn’t know she couldn’t rely on the Buysure scheme here.

Motorists should be able to buy a dream Mini for £9000 and expect reasonable value for money. Let’s remember, that’s all Caroline expected.

3/ Whinbush garage was clearly at fault. They didn’t just infringe the RAC Buysure standards but probably the Sale of Goods Act too.

4/ Warranty companies know that a poorly serviced car equals mechanical claims it will reject under cover of ‘wear and tear’. Maybe regular servicing should be a minimum standard for the cars they underwrite?

5/ Clearly the RAC MUST look at their Buysure scheme again to make sure other motorists don’t fall between the scheme’s cracks like Caroline.

I’d like to think they’d look at their invitation to inspect and service her car again.

Why wouldn’t they do this to give her the ‘confidence and peace of mind’ she expected, as promised, from a RAC Approved Buysure dealer?

And so I could add this as a happy ending to this sad story?

FOXY

In addition to this post we have since introduced and handed out Red Cards to both Whinbush Garage and the RAC Buysure scheme via our YouTube channel. After sharing this story with James Foxall at Telegraph Cars this was also featured in his column in June which we appreciate.

PS: If you’d like to comment here, please email info@foxyladydrivers.com.

PPS: Simon William’s statement that the RAC made a £662 gesture isn’t accurate. £150 came from Whinbush via Barclays and £150 came from The Warranty Group. Caroline did not accept the £362 from the RAC because she wanted them to inspect and service her car as she’d expected them to have done at the time of handover. And even if she had accepted £662 that merely pays for the tyres she needed to replace the illegal ones. Nor is his statement about Whinbush not knowing the condition of the brakes at sale time – that’s clearly not the case if he’d checked the MOT advisories here.

PPPS: We have since discovered that the RAC Warranty and RAC Dealer network are both run by The Warranty Group (TWG) Isle of Man Ltd. This suggests that dealers are appointed on the basis of their warranty sales potential and as such we do not consider this vested interest to be in the best interest of motorists who, like Caroline, trust a RAC named dealer to carry out rigorous and ethical pre-sales car checks. Knowing now that TWG only check dealers approx 6 times a year, we are not convinced that RAC Approved dealers are necessarily as conscientious or honourable as the RAC name might suggest. Just imagine, when a dealer is not as thorough as they should be, and a warranty claim is denied on the basis of wear and tear, as per Caroline’s experience, who is TWG more likely to support in the circumstances?

If the RAC (who has licensed TWG to provide this motoring service under their name) wishes to address our PPPS concern and/or put us straight here, we’ll publish their response for your information.

When I was young I was taught to save before I bought things. In fact I don’t think my Mum ever owned a credit card.

When I was young I was taught to save before I bought things. In fact I don’t think my Mum ever owned a credit card.